Summary

N26, the Berlin-based digital bank, eliminates trading fees for stocks and ETFs starting January 27, 2025, making investing more accessible and affordable. Customers can trade over 3,500 U.S. and European stocks, invest in ETFs, and set up free automated savings plans. This move aims to attract new investors, simplify financial tools, and position N26 as a leader in the fintech industry by removing barriers and fostering confidence in financial markets.N26 Drops Trading Fees for Stocks and ETFs to Attract More Investors

N26 eliminates trading fees

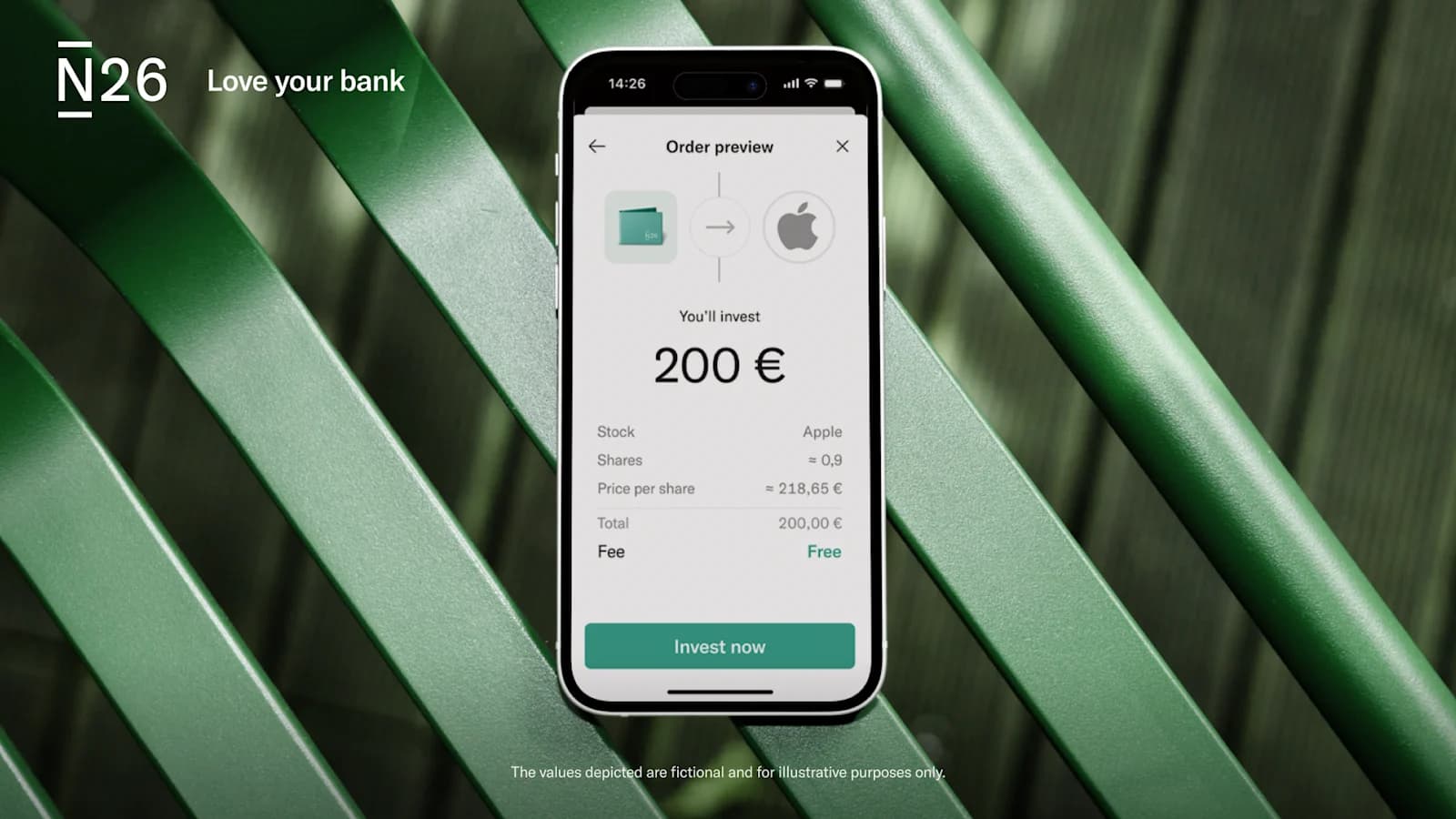

N26 eliminates trading feesThe digital bank N26, based in Berlin, has announced a significant change to its investment services. Starting January 27, 2025, the bank will no longer charge order fees for trading stocks and ETFs. Before this change, customers had to pay 0.90 euros for every transaction. This update is a key part of N26's strategy to make investing easier, cheaper, and more appealing for individuals looking to grow their wealth without excessive costs.

N26 customers can now trade over 3,500 stocks from U.S. and European markets, covering a wide range of industries and companies. Additionally, users can invest in ETFs, which are funds designed to track the performance of a variety of assets, offering an easy way to diversify investments. The removal of trading fees opens up these opportunities without the financial barrier of transaction costs, allowing more people to explore investment options with ease.

In addition to fee-free trading, the bank offers free savings plans. These plans enable users to set up recurring investments automatically, making it simpler for customers to save consistently over time. Automating investments ensures that even those new to finance can develop healthy saving habits and gradually build their portfolios without needing to actively manage every transaction. This added convenience aligns with N26's mission to make financial tools accessible to all.

Valentin Stalf, the CEO and co-founder of N26, emphasized that this move reflects the bank's larger mission to empower people across Europe to take control of their financial futures. By removing order fees, N26 aims to make investing more approachable, particularly for beginners who might have avoided the stock market due to perceived complexity or high costs. The company's approach is designed to break down barriers and encourage more Europeans to participate in financial markets confidently.

This initiative not only benefits customers but also strengthens N26's position in the highly competitive fintech industry. By broadening its services beyond traditional banking, the company continues to set itself apart as a forward-thinking player in the digital finance world. Offering innovative tools and removing common financial hurdles positions N26 as a go-to platform for modern banking and investing needs. As the fintech space becomes increasingly crowded, such bold moves could help N26 attract and retain a loyal customer base while fostering long-term growth.

News source