In this review

C24 Smart: Current Account That Pays You

When you search for a current account in Germany, you'd quickly notice that many banks require you to pay them a monthly or an annual fee just for managing your current account. In some other cases this fee is conditional, e.g. receive more than 700€ per month into your account to waive the monthly management fee. This way banks try to attract deposits which they can use to make money for themselves - way more than the “saving” you make by not paying that account management fee. But why is charging a management fee is so common? If you don't put enough money into your account, you have to pay, if you have too much money in your account, you also have to pay % of your balance known as “custody fee”. It's typical for traditional banks to let you pay here and there - sometimes without you even expecting it - I think this old paradigm is not fair to the customers.

C24 is totally different. It doesn't only provide you with a fully functional account totally for free, it also pays interest on your balance, regardless of how much you keep with them or how much if at all you deposit on a monthly basis! C24 has recently updated their interest rates and as of the time of this writing they give you 1.75% back on a quarterly basis for just keeping money in your current account. None of the other banks is offering an interest on deposits for the current account at the moment. I personally have been considering switching my current account to another bank a few months ago. C24 grabbed my attention because of the interest on current account balance and many other useful things they're providing absolutely for free.

I've been using a C24 Smart account as my primary bank account for about two-three months now, and here's the full experience you'd get if you open an account with them.

Pros & Cons in a Nutshell

Advantages:

- No monthly/annual management fees

- 1.75% interest paid to you on the amount in your account (same for subaccounts)

- Free unlimited Instant transfers

- 0% currency conversion fee when paying in foreign currencies

- 0.05% cashback on all Mastercard purchases

- Free debit Mastercard, girocard and virtual card

- Free cash withdrawals worldwide

- Four free sub-accounts (pockets)

- Direct debit notifications

Disadvantages:

- No long-term savings

- No trading account

- No credit products

- Overdraft is available only after receiving 3 salaries

- No travel insurances

- App interface and support are only in German

What is C24 and what do they offer?

C24 is a German bank, fully licensed and regulated by Bafin, the German financial regulator. It's relatively new - founded in 2020 but started getting popular only in the past couple of years. It's similar to N26, Revolut, DKB and ING in terms of their operations - they're fully digital and don't have bank branches like the ones you'd expect to see on the streets by the old established banks. At the same time C24 is offering modern banking services and customer support - all through a slick banking app at no cost. It's worth noting, C24 is a sister company to Check24 - a very established and quite popular service for comparing Insurances, Credit, Electricity, Internet and other offerings on the market. As expected, there's an integration between C24 and Check24.

C24 Smart - the free account packed with features!

C24 Smart is the default and most popular account model, yet it's packed with the most important banking services and perks you might have not even expected. Let's dive into exploring those.

C24 overview

C24 overviewFirst and foremost - management fees. It has none at all. You don't need to pay for either opening the current account or keeping it running, even if you don't use it at all.

Next, I'm always cautious about the so-called “custody fee”. While most banks in the world are welcoming deposits and encouraging people to keep money in their accounts - it's not the case in Germany. Many banks would charge you if you keep too much with them (usually more than €50.000). While it might not be a big deal for most of the people anyway, it's good to know C24 doesn't charge you any custody fees.

Now to the main feature, which is pretty unique among German banks - C24 pays you 1.75% per annum interest on the balance of your current account (on the balance up to 50.000 €). Imagine you got a spare €1000 just sitting in your account. Just by the fact it's there, you earn an extra €20 per year. This interest is dynamic in nature and subject to change in the future, but the good thing is it's working for you every single day. With the example above, that means you'd accumulate €0.05 every day. C24 pays out your interest quarterly. You can track how much you earned at any time and it's updated daily. It's really pleasant to watch how your balance is growing day over day!

Note:

The interest rate is dynamic and the bank can change it depending on the market conditions. For example, recently we've been seeing a downward trend in savings interest rates. Just recently C24 was offering 2.25%, then switched to 2% and as of December 2024 they changed it to 1.75% following the decreasing interbank overnight cash rate (the primary way banks make money on the customer's deposits).

C24 interest

C24 interestFour free pockets with unique IBANs earning interest

In addition to the main account, you can optionally create up to four sub-accounts, each with its own IBAN. Each of those sub-accounts earns same 1.75% pa interest the same way as the main account:

C24 pockets

C24 pocketsRegular pockets earn interest on funds up to 5.000 €, the special Savings account earns 1.75% pa on up to 100.000 €.

The Tagesgeldpocket is a daily savings account. It earns the same 1.75% pa interest as the main account, albeit it has a higher 100.000 € earning balance limit. If you want to intentionally set a large balance aside from your main account - here you go:

Savings pocket

Savings pocketRegular pockets can be used for budgeting purposes. You can create custom names and attach icons to easily recognize those in the app. C24 Smart gives you 4 free pockets(subaccounts), which should be more than enough to get organized around your personal budget. For example you can create a subaccount and call it “Haushalt” for managing your home-related expenses such as paying rent or buying food. Another account could be “Vacation”, using which you can save some money every month for your upcoming trip.

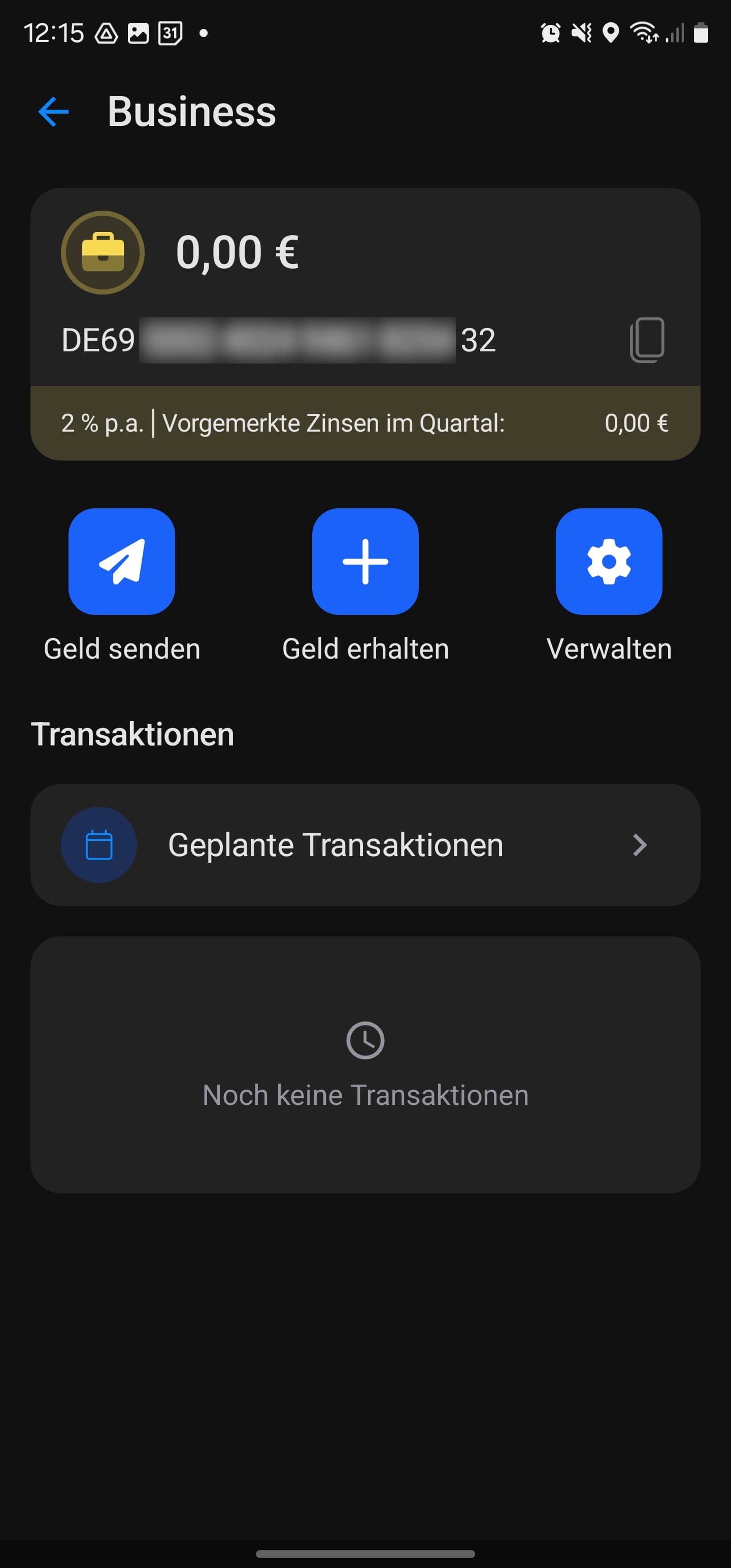

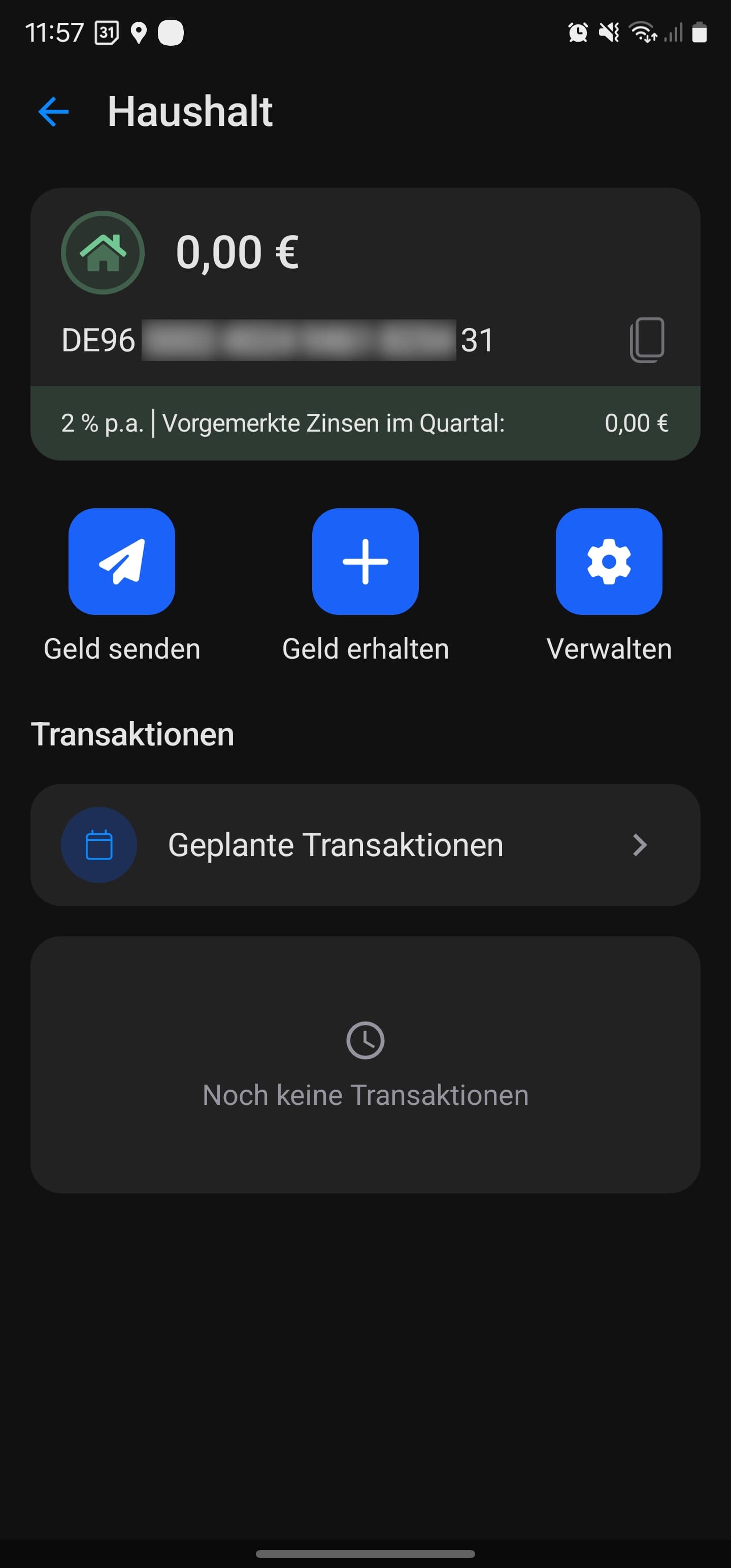

I created two additional pockets for managing home and business related expenses:

Business pocket

Business pocket Haushalt pocket

Haushalt pocketEach pocket that you create receives its unique IBAN number automatically, which means they can be used as an independent account for sending and receiving money! You can also attach and reattach your physical or virtual cards to those pockets, which makes it so flexible to organize your funds and payment methods. For example, you can get a virtual card, attach it to the Haushalt pocket and then use that card for paying for home related expenses! You can set up direct debit on the pocket too!

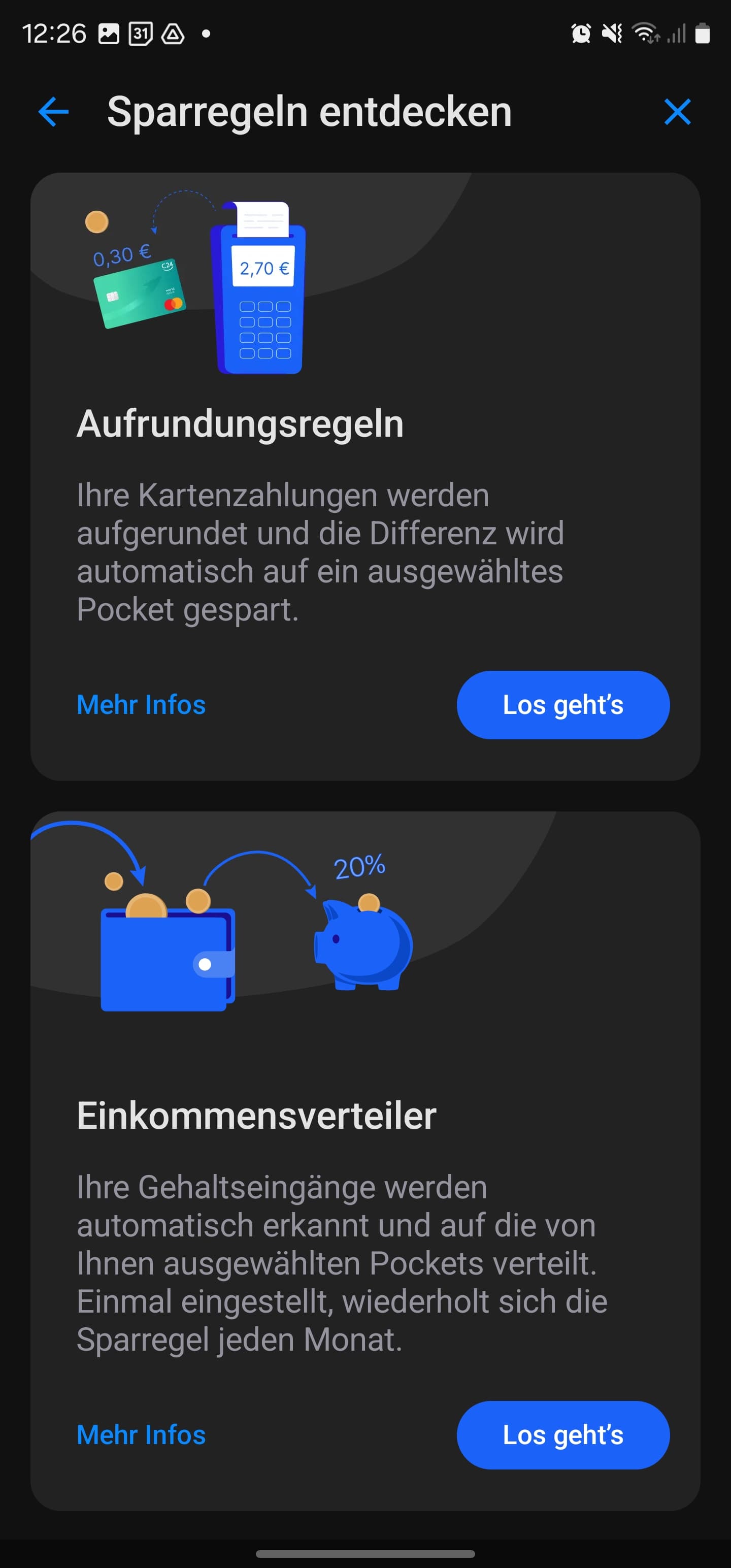

Another useful feature around pockets is savings rules. For example, you can setup a rule for rounding you card transactions and transferring change to a specific pocket. For example if your card transaction is 9.50 €, you can set it so it will automatically make it 10 € and put 50 Cents to one of your pockets. You can set a similar rule on incoming funds. Whenever you receive a salary it can be automatically sorted across multiple pockets. There are multiple templates available, and those rules are super easy to set up:

Savings rules

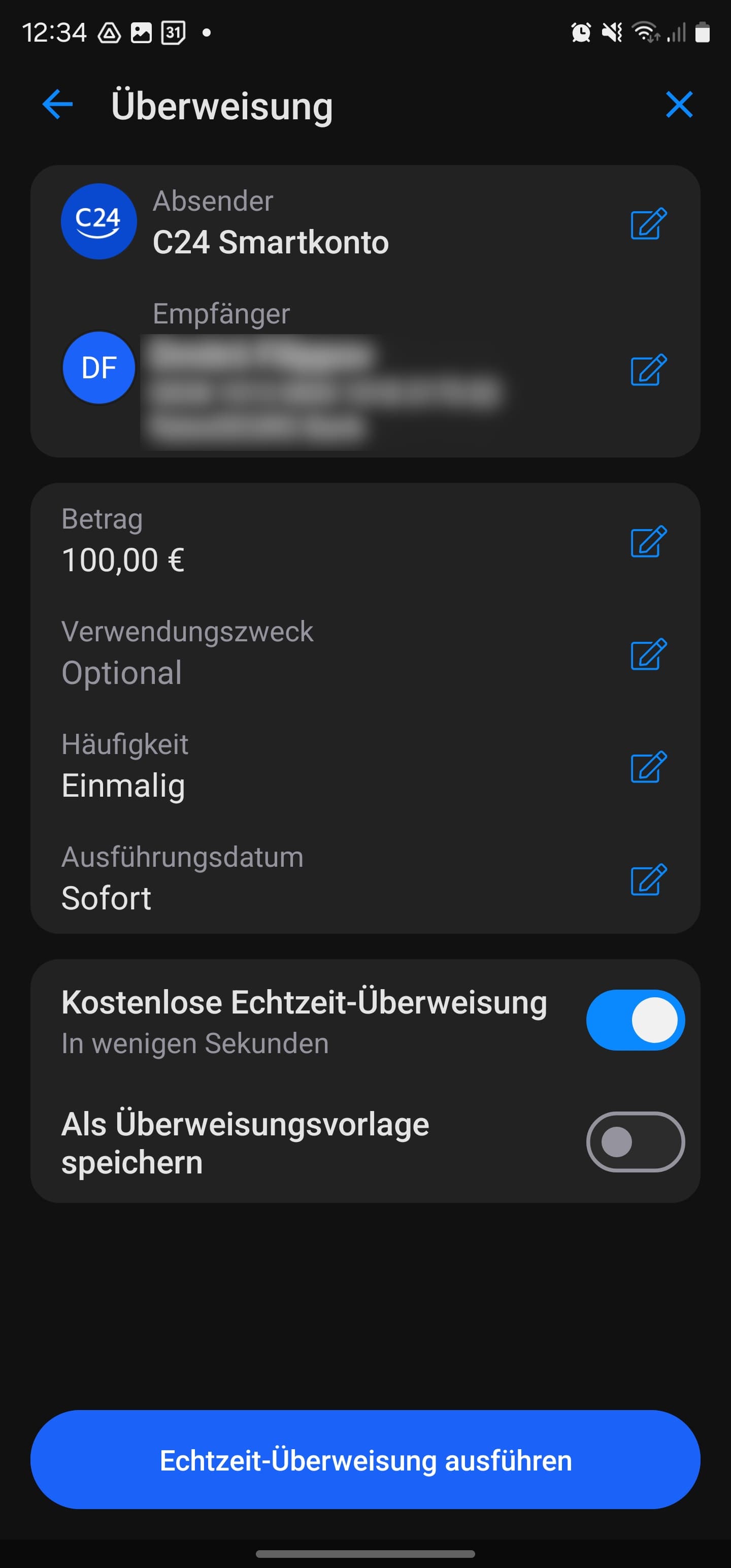

Savings rulesFree instant bank-to-bank transfers

Most of the banks in Germany make transfers instant and free only when you're moving money between your accounts or sending them to customers of the same bank. Imagine the same experience sending to any bank? That's where SEPA Instant comes into play and C24 lets you send an unlimited number of instant bank-to-bank transfers.

This is something only a few banks in Germany do. By default you'd pay €0.5 - €1.5 per instant transfer at other banks. I personally find it very cool to be able to transfer money instantly by default instead of waiting for a couple of days until money reaches the destination using the standard SEPA transfers.

Free Instant Transfers

Free Instant TransfersGirocard, Mastercard and Virtual cards

In addition to a fully functional current account that earns you interest and provides you with an unlimited number of free instant bank transfers - you get a full suite of cards covering any potential payment scenario you might face in Germany and when travelling abroad. You get a Debit Mastercard, a Girocard and a virtual card. All for free!

C24 Mastercard

C24 MastercardNot only does the Mastercard Debit card come with no management fee, it also earns you a small cashback (0.05%) on every purchase! What's also cool about the C24 Mastercard is that it includes 4 free cash withdrawals domestically and worldwide, making this card suitable even for traveling! 4 free cash withdrawals per month is more than enough in my opinion (in my opinion) - so you can feel free to use any ATM which is nearest to you when you need to grab some cash. What makes the debit card even more suitable for traveling is the fact it has 0% fee for currency conversions. Let's say you're purchasing something in USD online or physically if you actually traveled to the US - the conversion from USD to € will happen using the Mastercard rate which is very close to the interbank exchange rate and is considered to be the best for retail customers. This is amazing to know you can use your Mastercard the same way domestically and abroad without a need to worry about any fees, even when withdrawing cash.

C24 Girocard

C24 GirocardThe Girocard looks good and is made of the recyclable material. You can set your custom pin on both the Girocard and Mastercard. I wouldn't use the Girocard for anything other than paying locally in the situations where the Mastercard would not be accepted - yes many small merchants may refuse Mastercard for purchases under €10 - Girocard would come in handy in such situation. Also quite often when you go to a government agency for some paperwork - you might be required to use a Girocard for payment. That's another situation where it would save your day. I would not use it for cash withdrawals, given that you have to pay €2 per withdrawal when using the Girocard. Needless to say, the Girocard is not suitable for traveling. It's not connected to either Maestro or Vpay which would let it work overseas.

C24 Virtual Mastercard

C24 Virtual MastercardWith C24 Smart you can also get an instant virtual card which you can add either Google or Apple Pay. I created mine right after opening an account and it worked like a charm immediately with my Google Pay. The first virtual card comes for free - if you need more virtual cards - you can always get one for €1.99 or consider upgrading your account to the one that includes more cards.

Another cool feature about cards and sub-accounts is that you can reassign your card to sub-accounts. You can create up to 4 sub-accounts and assigned each card (giro, virtual Mastercard or physical Mastercard) to a different account.

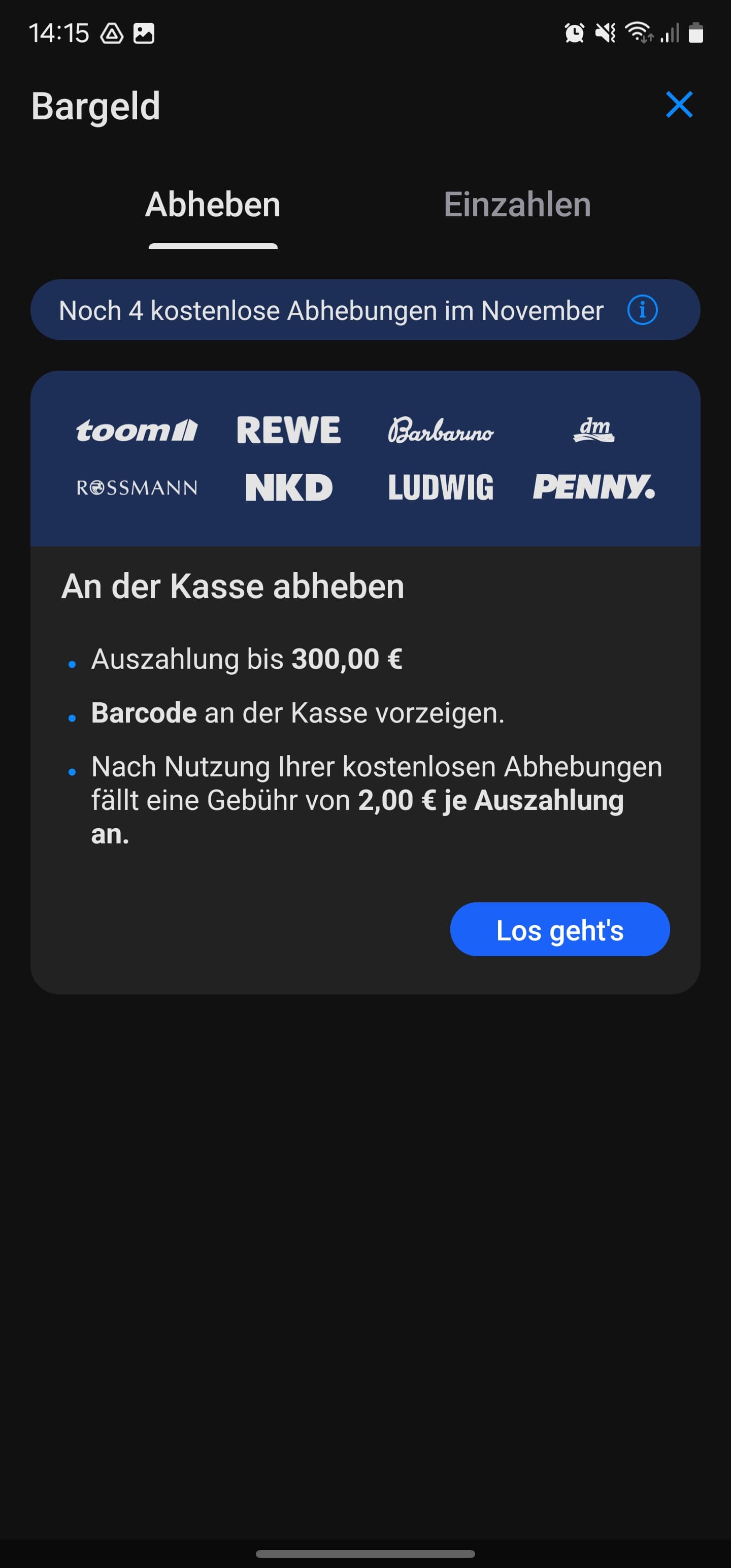

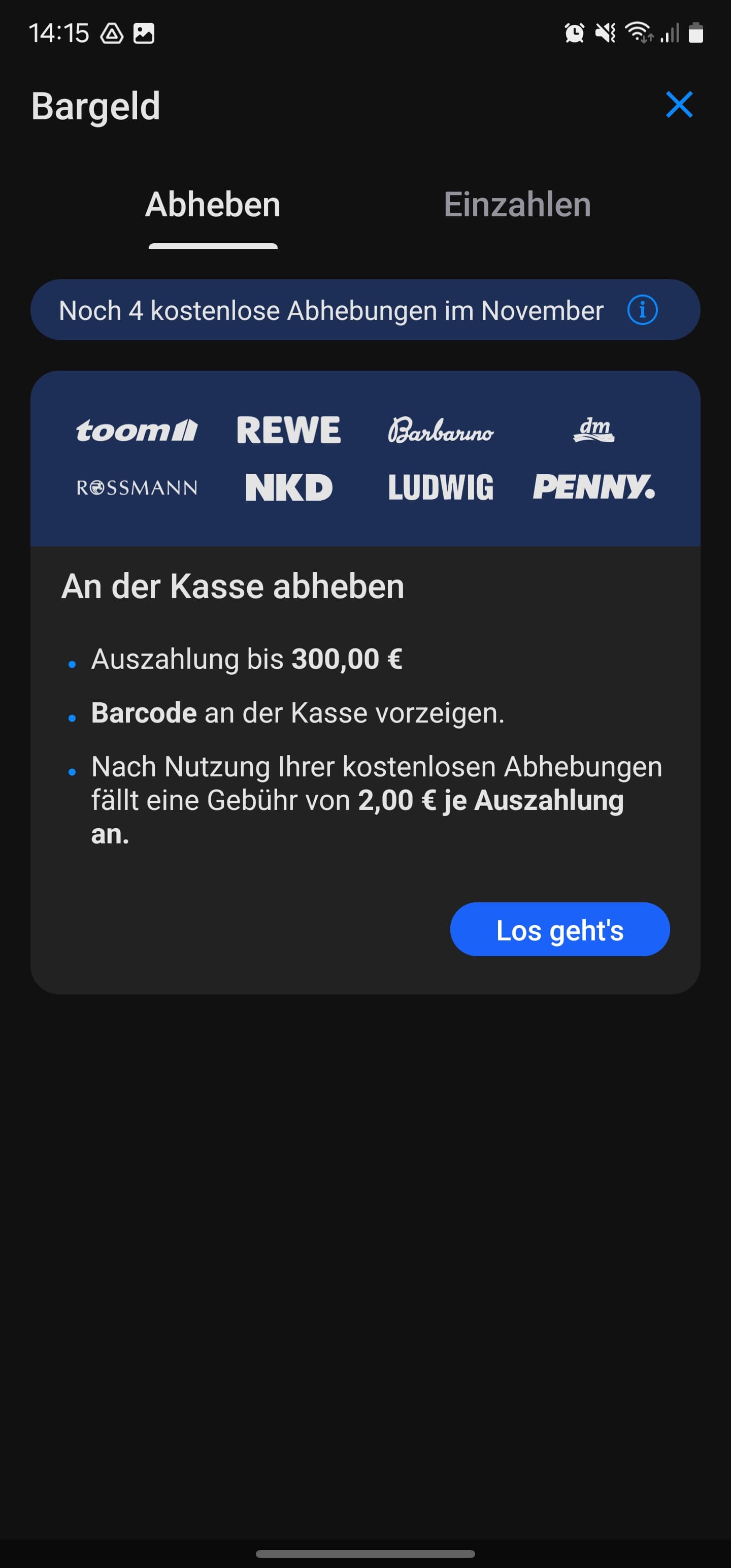

C24 Smart includes four free card withdrawals that you can use at any ATM worldwide. Another option would be using one of the partner stores, although partner store withdrawals are limited to 300 € per withdrawal.

Cash Withdrawal

Cash WithdrawalAs for cash-in, C24 doesn't provide you with free options, however you can still top up your balance with cash at partner stores with a 1.75% fee or a partner bank - Reisebank with a 7.50 € per cash-in fee.

Cash-in

Cash-inDirect debits and scheduled payments

Direct debits and scheduled transfers are free and reliable. I've never experienced any issues with them. What I found really amazing is that C24 sends you notifications about the upcoming direct debits hitting your account within the next few days. That gives you an opportunity to make sure you have enough funds in your pocket or the main account so the transaction is successful when the time comes.

Direct Debit Notifications

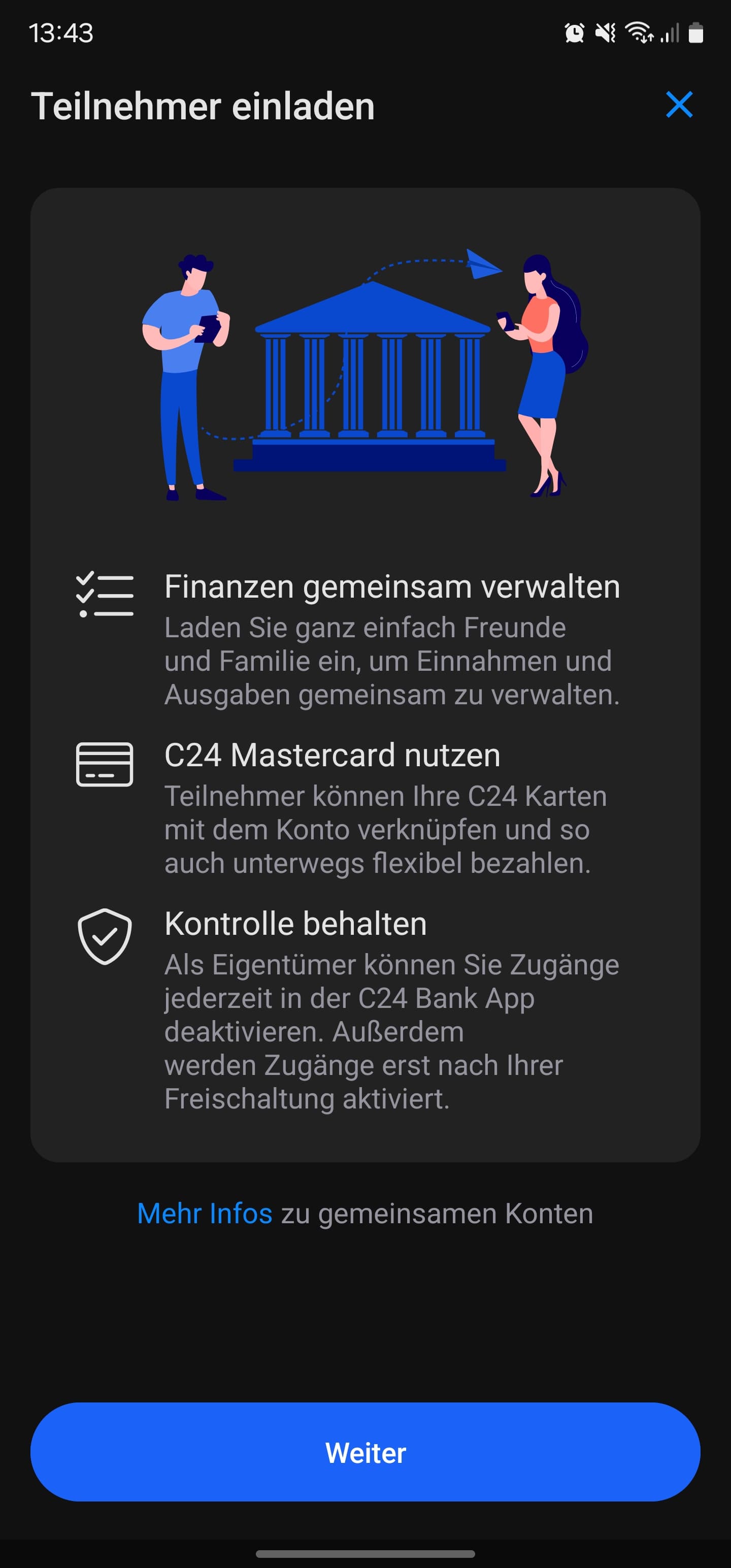

Direct Debit NotificationsShared Pockets as Joint Accounts

You can have joint accounts with your friends or family members using the “Shared pocket” feature. On the C24 Smart plan, you're allowed to share a sub-account with one other C24 customer. If you want to have more people having access to sub-accounts (pockets) - you'll be required to upgrade to other plans available at C24. I haven't tried shared pockets yet, but will encourage my wife to open an account with C24 for easier money sharing.

Shared Pockets

Shared PocketsRewards & Cashback

C24 Smart features a unique cashback program where you accumulate 0.05% cashback on all your Mastercard purchases in the form of Check24 points (please note C24 is a subsidiary of Check24). Technically you don't get cash, but bonus points, the good thing is with Check24 you can not only use those points in the Check24 marketplace, but also cash them out to your bank account! Might be not very straightforward at the first look, but this is real cash that you'd be getting back!

C24 Points

C24 Points Check24 Points Redemption

Check24 Points RedemptionDid you know

C24 has two other current account models? You get way higher cashback (0.5%) with C24 Plus (€5.90 per month) and whooping 1% with C24 Max (€9.90 per month).

C24 doesn't offer any welcome bonuses, however they do have a referral program where you'd get €70 for every friend you bring to the bank!

Check24 Connection

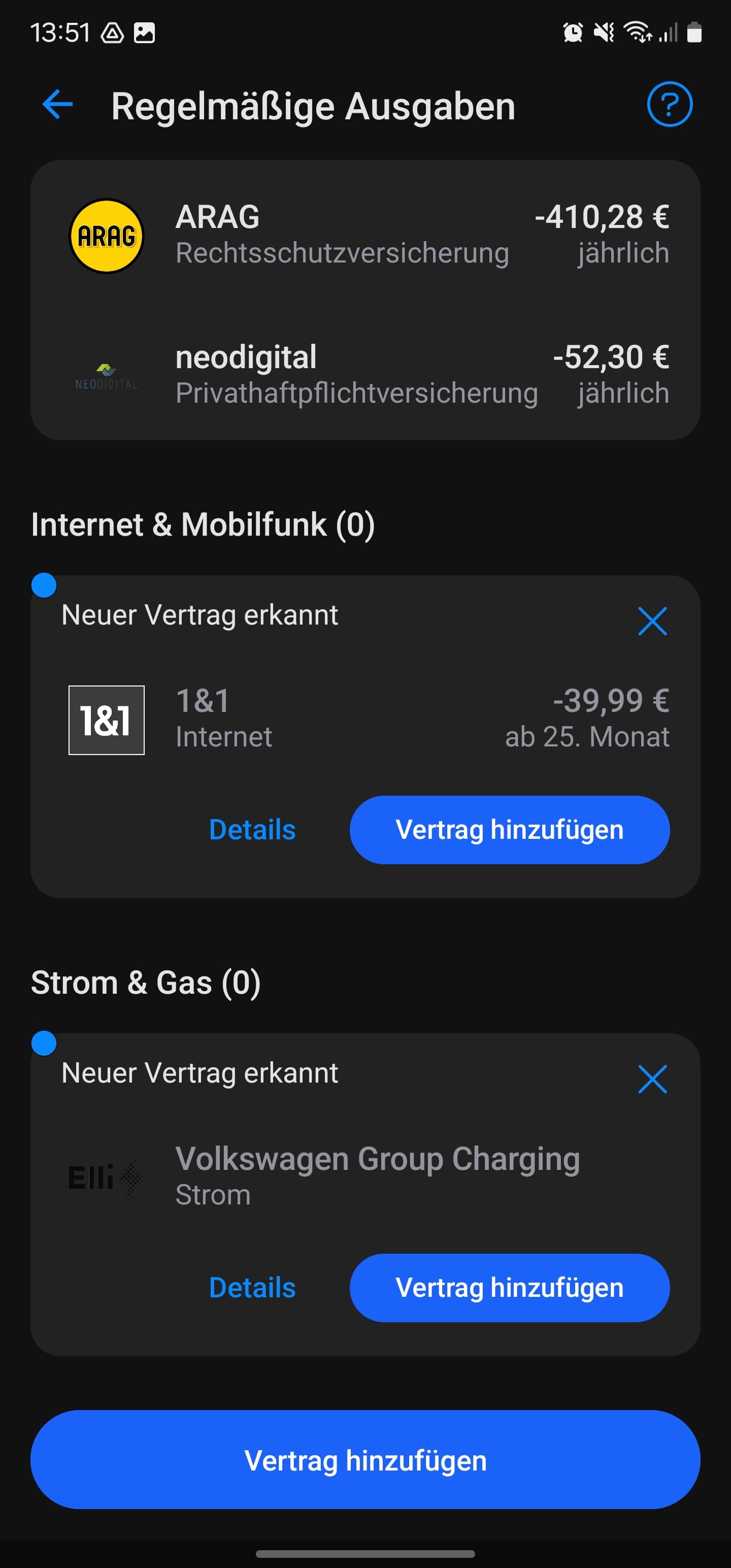

I mentioned above that you'd get cashback for your C24 Mastercard purchases as Check24 points. C24 and Check24 relationship doesn't stop there. You can connect your Check24 account to C24 account and it will be tracking your insurance, internet and other payments, as well as recognizing some other recurring payments to give you suggestions on optimizing your spending.

C24 shows insurance subscriptions

C24 shows insurance subscriptionsOverdraft and Credit

The only credit product that C24 has at the moment is overdraft. You don't get it automatically after opening the account. The condition to have access to overdraft is to receive your salary into C24 account for at least three consecutive months. There's no way you can speed up the process of getting access to overdraft. You literally has to receive salary for three months into your account before they enable it to you. If you need money urgently C24 helps you with finding another provider via Check24 comparison tool.

C24 doesn't issue credit cards - while I think credit cards are so much needed for particular scenarios, I don't see it as a downside for C24. There are so many great credit card options out there that you can simply connect to your C24 account without a need of creating a separate account with another bank.

Savings & Trading

Apart from earning you 2 percent pa interest on your balance across any sub-account at C24, there are no other options to save or grow your money with C24 yet. No long-term fixed savings product as well as no Trading functionality (neither for the stock market nor crypto). At the same time I do appreciate how well the flexible savings are done. Your main account earns you 2 percent on the balance up to 50.000 €, the daily savings pocket earns the same 2 percent put up to 100.000 € balance and each of the four free subaccounts gives you 2 percent on up to 5000 € each.

Insurances

The card is suitable for traveling, having no currency conversion or cash withdrawal fees (up to 4 free withdrawals worldwide per month), however it doesn't feature any insurances, even optionally. The paid plans don't have travel insurance either. The only insurance you can get with the paid plans is the Purchase and account protection insurance, which is the most basic one and comes pretty much with any credit card. My suggestion would be getting a good credit card from another provider as a companion card linked to the C24 account. That's exactly my setup.

Accessing your account

C24's main interface is the Mobile app which is minimalistic, but is very well organized. The app has all the available functionality in it, including access to customer support. It's also possible to perform certain actions with online banking. You don't need to have separate access to C24 online banking. You login to online banking using your app by scanning a QR code and then entering the one-time code.

C24 gets 4.8/5 stars on both Google Play and Apple's App store, which is the highest score among German banks which is a testament to how well the app is structured and the seamless experience while using it. I haven't had any major issues with the app while using it pretty much on a daily basis for the past two months. Occasionally I got some glitches with repeating push notifications, but those are not a big deal. The app has been available at all times, and all features worked as expected.

Other options with C24 and reasons to upgrade

Other options with C24 and reasons to upgrade

C24 offers two other plans with even more benefits:

| C24 Smart | C24 Plus | C24 Max |

|---|---|---|

| C24 Standard Mastercard | C24 Mastercard with color choice | C24 Metal Mastercard |

| 0.05% Cashback | 0.5% Cashback | 1% Cashback |

| 4 free pockets | 20 free pockets | 20 free pockets |

| 1 free virtual card | 20 free virtual cards | 20 free virtual cards |

| 4 free withdrawals/m | 20 free withdrawals/m | 20 free withdrawals/m |

| x | 1 free cash-in/m | 1 free cash-in/m |

| x | Arag Account and Purchase Insurance | Arag Account and Purchase Insurance |

| x | x | Check24 Travel Club Membership |

If you want to get more from using C24, i suggest you consider the other 2 account models they're providing:

C24 Plus

C24 Max

With C24 Plus (5.90 € per month) you'd get a physical debit card with the color of your choice and 0.5% cashback on all card purchases. C24 Max (9.90 € per month) will give you a stylish metal card and 1% cashback. Choosing either C24 Plus or Max will also give you up to 20 pockets, instead of 4 available with C24 Smart. They both give you up to 20 free virtual cards and 20 free withdrawals. Both C24 Plus and C24 Max include the purchase and account insurance. C24 Max additionally gives you access to Check24 Reisegoldclub which is a status program by Check24 providing you with discounts, free travel health insurance and other perks. With both C24 Plus and Max you also get one free cash-in per month if that's of interest to you. C24 Max also has premium customer support with video calls in case you have any difficulties while using your account.

Please note that all services provided by C24 including the app and web interfaces are in German. This might be an issue to some non-German speaking users. The interface should be easy to navigate even if you don't speak German, however it might be more challenging if you need to ge tin touch with customer support. While the support is officially German only, you might still be able to chat with a representative in English or use a translator when chatting.

Putting it all together

I've been using the C24 Smart for 2 months now and I think this is the best current account available right now for personal use. It's free, packed with various features and services including free unlimited instant bank transfers, free Girocard, mastercard and virtual cards, the main account earning you 2 percent interest is stellar, and the ability to create sub-accounts which are fully functional accounts with their own IBANs. There's little to nothing to wish for additionally! I wish they had trading functionality in the app, but I'm using a separate brokerage app, so that's not a big deal for me - some long-term savings options would have been a big advantage for me personally, but I'm happy with a high 2 percent interest flexible savings. I wish I could get access to overdraft faster than waiting for three months and a credit card with extended insurances would be a great addition, however as I mentioned before, getting a credit card from another provider of your choice might be an even better option. After using C24 Smart for about two months now I can definitely recommend it to anybody who's interested in a modern bank account and appreciates earning interest and cashback while using one!

Alternatives

C24 has some fantastic current account options, however there are some good alternatives that I'd like to mention here:

Santander BestGiro

Advantages - Santander is a bigger well established bank with branches across the country - More banking services are available, including credit options and credit cards

Disadvantages - Girocard is 0.99€ per month - No interest on the current account (daily savings pays only 0.3% interest)

N26 Standard

Why I like it

- Nicer app

- Trading functionality

Disadvantages

- No Girocard

- No interest on the current account