In this review

Amazon Visa: A Complete Review of the Free Cashback Card in Germany

Amazon Visa

Amazon VisaAmazon's credit card has made its reappearance after being out of the market for about a year, promising fresh features and a revamped user experience for loyal shoppers. It's now a completely different product! The old Amazon card was great — let's explore whether the new one is even better. I've been using the new Amazon Visa credit card for about two months now and for me it works well, albeit only in particular scenarios. Check out this review as well as some tips at the end on how to use this card and what other credit card options to consider.

A Bit of History

The previous version of the Amazon credit card powered by Landesbank Berlin (LBB) was an extremely popular credit card. It was free for the Amazon Prime members and provided 2-3% discount/cashback when buying on amazon.de and 0.5% for all other purchases. It was phased out at the end of 2023, and Amazon announced its successor only in August 2024. The new Amazon card is also a Visa credit card. It is now issued by "Zinia" the German branch of the Spanish Openbank, a subsidiary of the Spanish banking group Santander.

General Overview of Amazon Visa

The card is catchy to say the least, with its sleek black design, vertical layout, colorful rim, and prominent Amazon logo at the center. A black card with a vertical layout, a colored rim and a giant amazon logo in the center, comes from a large reputable company, promises up to 2% cashback on selected offers for Amazon Prime members, 1% cashback on all purchases on Amazon.de, 0.5% on all other card purchases, and it is free from annual management fees.

Advantages and Drawbacks

Below are the detailed advantages and drawbacks of the card, organized for clarity:

Advantages

- 1% cashback for purchases on Amazon.de

- 0.5% cashback on any credit card purchases

- Up to 2% cashback on selected offer days (Prime members only)

- Amazon Visa is a real credit card that can be used either in Charge or Revolving mode

- Optional Travel package that can be enabled when necessary

Drawbacks

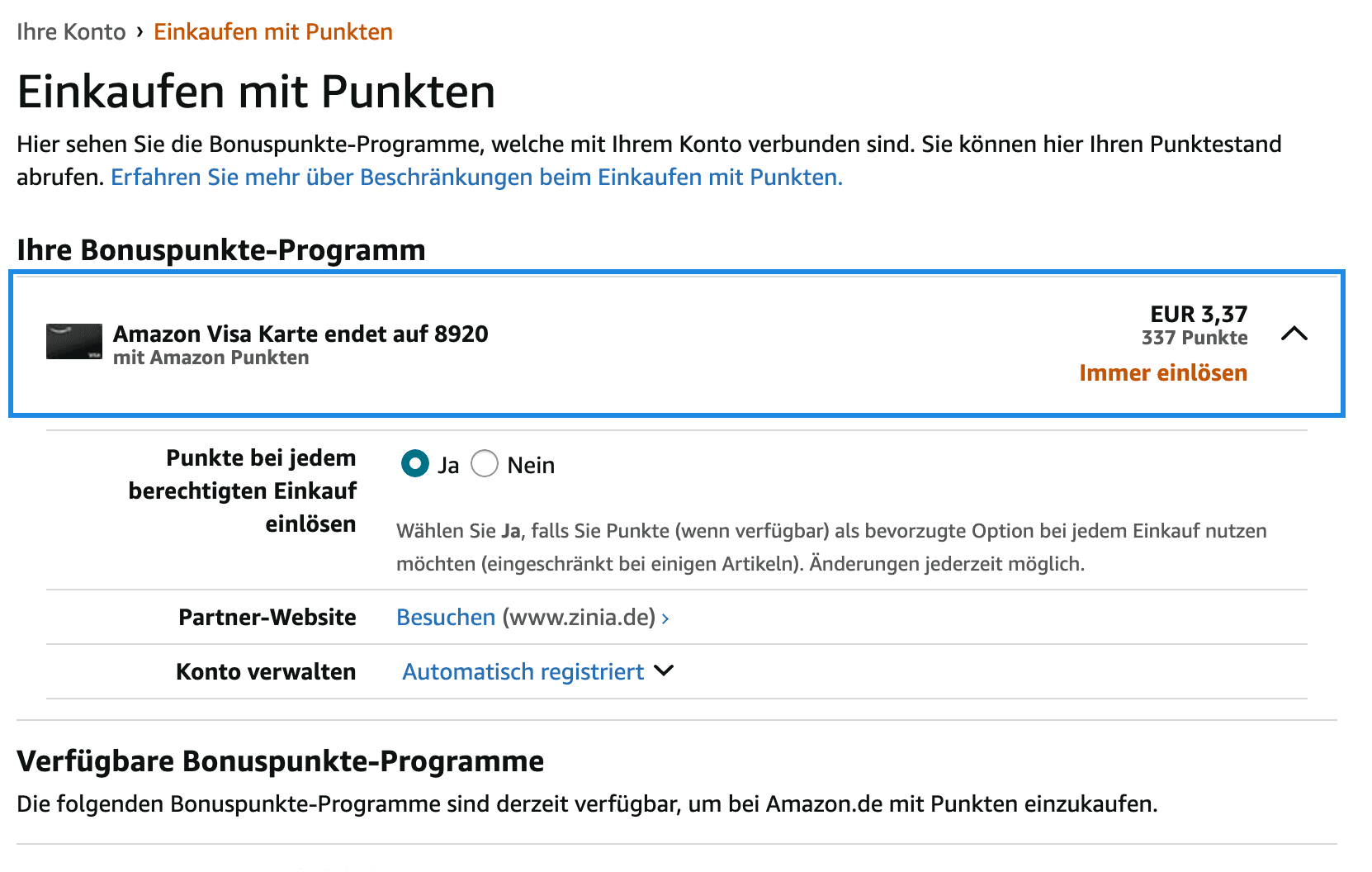

- Cashback (Amazon points) can be used only on Amazon.de

- Travel option is relatively expensive

- 1.5% currency exchange fee (waived with the Travel option)

- 5% cash withdrawal fee (waived with the Travel option)

- Only 30 days zero interest period

- Annoying security measures

It's very important to understand that the Amazon card doesn't give you real cash back (money to your card/bank account), instead you get Amazon points which are equivalent to cash. You can't cash those out, so the only option for you would be using them on amazon.de which is not a problem if you're an Amazon customer or want to become one. If Amazon usage is not in your plans, you'd rather go for another card.

Honestly, although it's advertised to have 2% cashback on selected days, I haven't seen the opportunity to buy anything with this cashback for 2 months now - including during the black friday week. It might be somewhere, it's just impossible to find it anywhere. The advertised 2% cashback has not been evident during my usage.

The card can be used in two modes: charge and revolving which is common for many modern credit cards. You can set your preferred mode when ordering a card and switch it later at any time. The charge mode lets you pay zero interest, the downside is that you have to repay the whole amount on the monthly bill at the end of the billing period. That means you can use the credit money for up to 30 days (depending on the time of your card purchases) for free. This is my preference for all my credit cards, so I've been using Amazon Visa as a charge card for the entire time. If you prefer to repay the debt on the credit card in installments - that's where you need to select revolving mode. Beware the interest on this card is pretty high at eff. 20.13% p.a. and you also have to pay the interest starting from your first transaction, not from the end of the billing cycle, so this type of credit can get expensive pretty quickly and you might consider other alternatives if you need credit for a long time.

I like the fact that this card doesn't require an additional bank account to be opened, so you can use your existing bank account as a reference account which will be direct debited on a monthly basis by Amazon Visa. This is very convenient and pretty modern approach the best credit cards are following.

Purchasing goods and services abroad has its pros and cons with this card. For example, the 1.5% foreign currency fee and 5.4% ATM withdrawal fee can be inconvenient, but the optional Travel+ feature, which includes no currency fees and free ATM withdrawals, adds flexibility and value for travelers. On one hand it's horrible to see that by default it's not suitable for travelling: no insurances, 1.5% fee for paying in foreign currencies, a whooping 5.4% fee for cash withdrawals, o the other hand there's this Travel+ option available on demand. You can purchase this additional option in the app at any time when you need to travel, and will give you a travel insurance, 0% fee paying in foreign currency, 5 free withdrawals from ATMs worldwide all that for 7.99 EUR per month. This price seem to be high at the first glance, as compared to some other decent credit cards on the market, however the big advantage here is that you can turn this option on and off, while you have to pay a subscription fee every month regardless with some other “premium” cards providing you with travel features. So I'd say if you're travelling a couple times a year - this option is definitely worth a shot as it will be way cheaper than getting a premium card with travel benefits for the entire year.

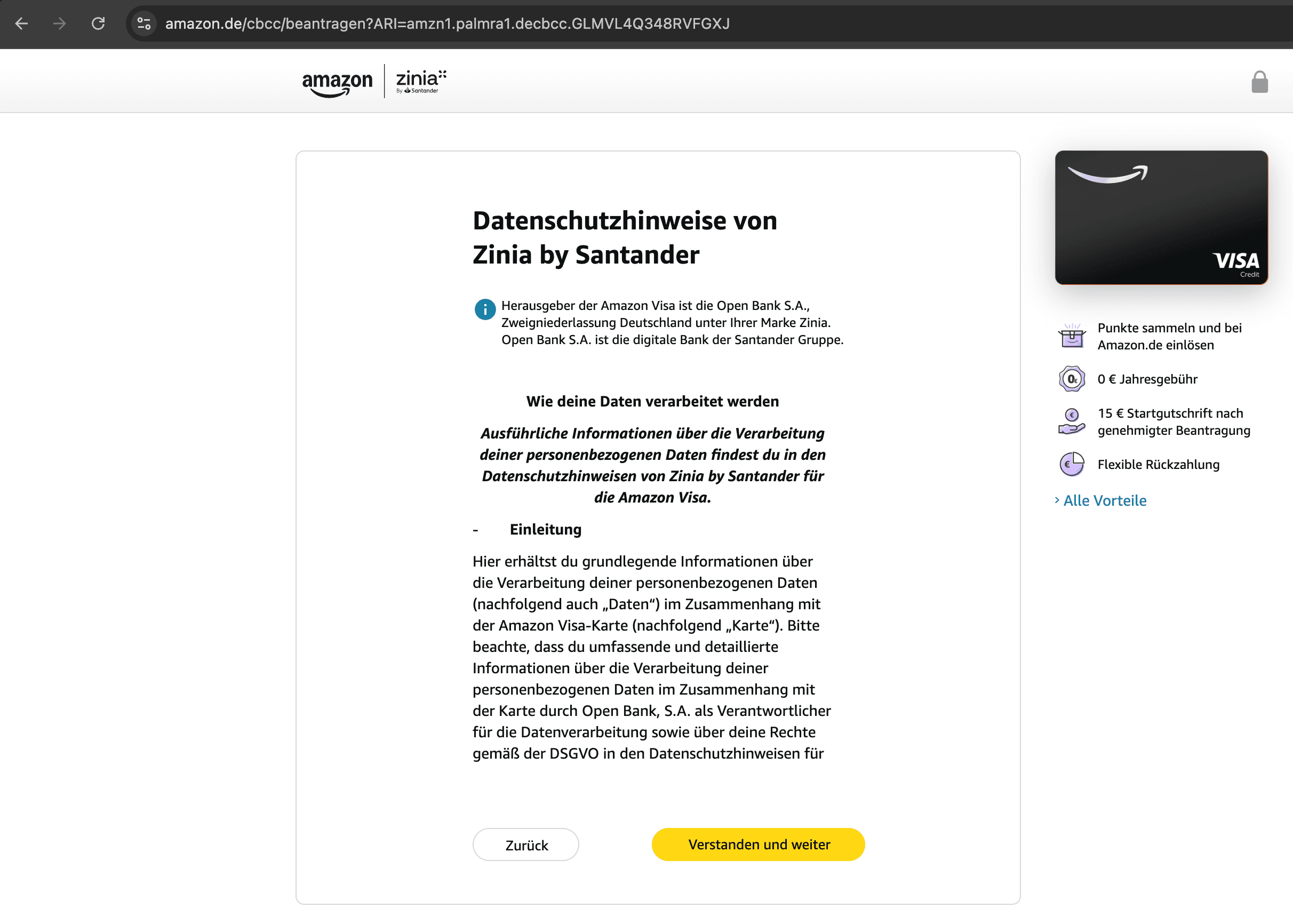

Ordering a card

The process of ordering a card is simple and user-friendly. Starting from the Amazon website you'd get to a page explaining you some data protection regulation, basically letting you know that Zinia, Openbank and Santander will have access to your personal information:

Applying for Amazon Visa

Applying for Amazon VisaWhat's Zinia?

The issuer of the Amazon Visa credit card is Openbank under its brand Zinia. Openbank is the digital bank of the Santander Group, one of the largest financial groups in the world.

On the start page you just need to acknowledge and proceed to the card ordering form, which will be asking you for some basic information, like your name and date of birth. You'll also create an Amazon.de account or login into an existing account in the process. This is a required step, given that points you'll be collecting have to be linked to an Amazon account. There was nothing special about the card application process, however I appreciate how well Zinia has structured it. Instead of asking for all the information they need to issue your card in one go, they've broken down the process into multiple steps, where after answering some initial questions you'd register with them and receive a confirmation email with a pre-approval for 2000 EUR inviting you to proceed giving them more info to complete the process. That's a very important aspect of this credit card. Your credit limit is going to be 2000 EUR when you get the card. However, you can request a credit limit increase any time after receiving the card. That will involve some additional credit checks before approval. That would include letting Zinia to look into your current account and analyze your income and spending habits. It's pretty similar to providing a credit organization with your bank statement for risk analysis. The max limit that can be requested according to the app is 40,000 EUR.

Setting up the card

Once you get approved by Zinia after completing the application process, you'd get a confirmation email. What's interesting is that you can immediately add the credit card to Amazon.de upon registration with some provisioned 200 EUR limit which is going to be increased to 2000 EUR when you activate your card after receiving it. The process of adding the card to your Amazon.de account is automated and pretty straightforward. Once you receive your card by post, you'd need to activate it using the Amazon Visa app, which involves entering some card-related information as well as entering codes sent to you by sms. The card supports a custom PIN which you can set up in the app.

Amazon Visa arrived

Amazon Visa arrivedAmazon Visa is a real credit card with a credit limit. You can use it in either of the two modes:

- Charge (recommended): full repayment of the bill on the monthly basis. This would also mean you'd be paying 0% interest at all times and the maximum credit period in this case would be 30 days.

- Revolving: with partial repayment. In this case you'd be paying a portion of the monthly statement and the rest of the debt will revolve into the next month's statement.

You have to select one of the two modes when requesting a new card, however it can be changed later in the app if you decide to switch. I strongly suggest you choose the Full repayment mode and repay the full bill amount on a monthly basis. Otherwise with the flexible partial repayment you'd be guaranteed to pay a whooping 20.3% pa on the revolving amount - and your debt can quickly go out of hand. Amazon Visa features one of the highest interest rates on the market and you should be avoiding it at all times - there are better interest conditions with many other cards.

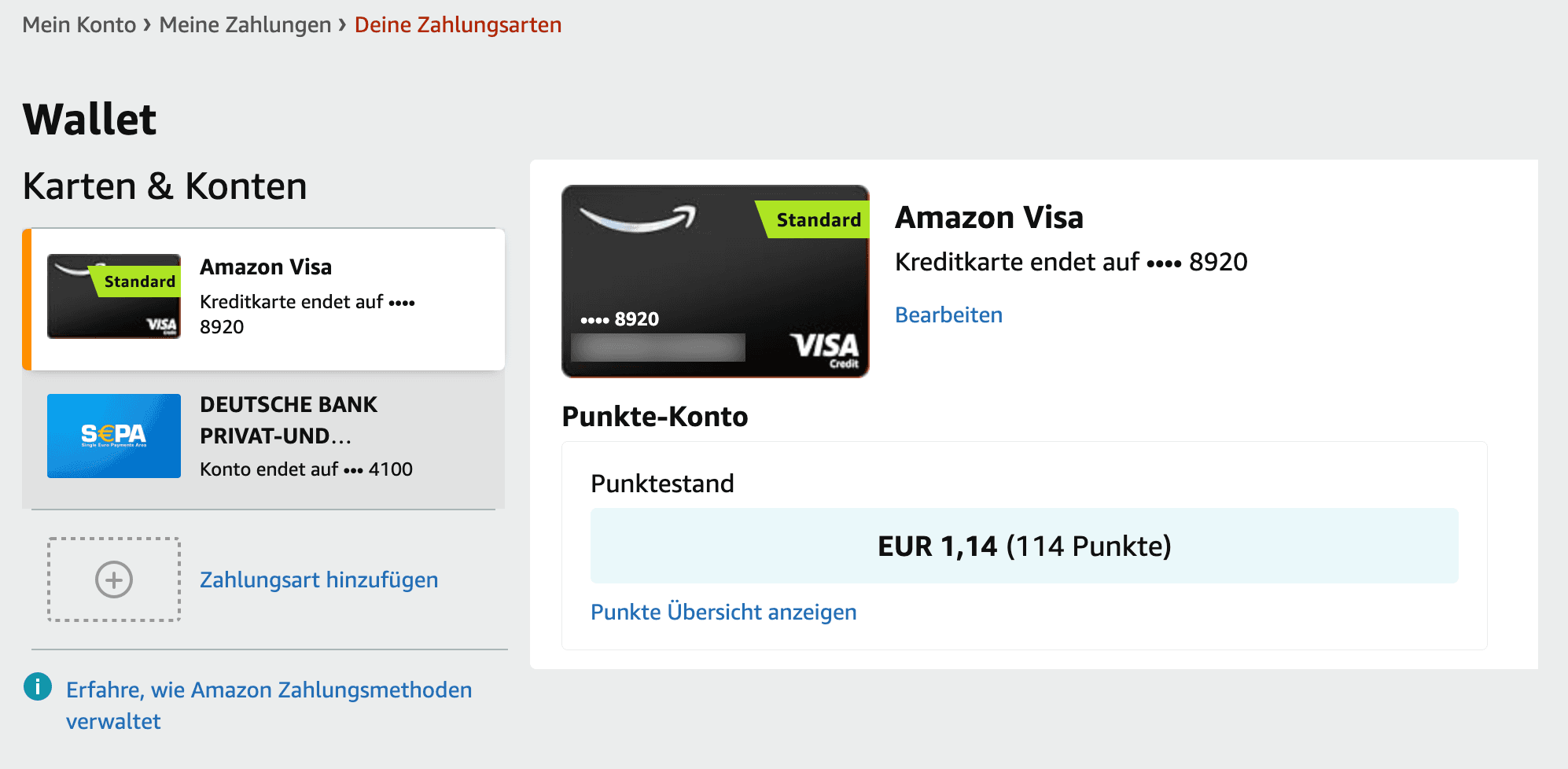

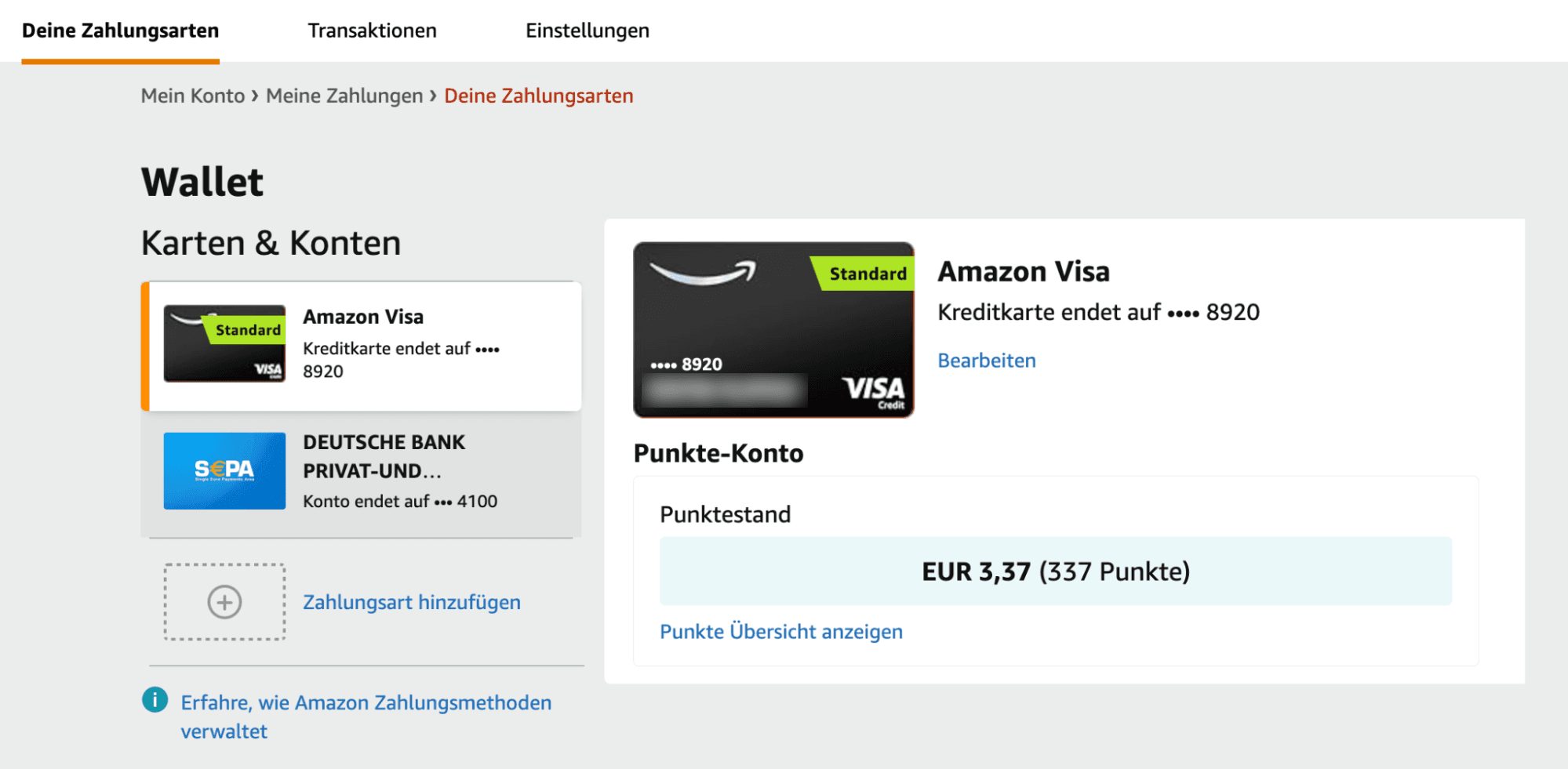

Using the card on Amazon

Alright, this is the primary use case and the main reason for this card's existence. Amazon wants you to buy more from them, so the credit card would let you do it. Good for them… Well good for you too - you don't have to worry about having enough money in your bank account when purchasing something - the money is always readily available on the credit card so you can repay your debt next month (0% interest if you use it in a full repayment mode) I selected the Amazon credit card as my main payment method on Amazon to start collecting 1% cashback on my Amazon purchases:

Amazon Visa on amazon.de

Amazon Visa on amazon.deWelcome bonus

You'll receive your welcome bonus after your first transaction. The regular welcome bonus offered by Amazon Visa is 15 EUR. Every now and then they organize promos. For example the recent one with 30 EUR welcome bonus if signing up for the card before Dec 15th, 2024.

I received my bonus pretty quickly in a couple of days after making my first card transaction. The bonus lands into your credit card and offsets your current or future debt in the billing statements. Effectively at the end of the month I had to pay 15 EUR less than what I've spend with the card.

Using the card domestically

The card is very much suitable for everyday purchases as long as you're staying within the allocated credit limit (2000 EUR). Paying in Euro is free and you'd be collecting 0.5% cashback on all non-Amazon.de purchases. I successfully paid with the card at Edeka. Although I had one instance when the card got declined when paying at a grocery store. The second attempt worked. I have no idea why it got declined firsts. It never happened again so I consider it not a problem.

The Amazon card is also suitable for online purchases. The card pays you 0.5% back, so why would you use any other payment method unless you get your cashback elsewhere? Just be aware about some pitfalls - specifically when paying in currencies other than Euro. Amazon Visa would charge you 1.5% when paying a foreign currencies. So I'd advise you to pay with another card or, well, there's this Travel+ option for 7.99 EUR per month enabled on demand that waves the fee - not sure this would be the right use for this constantly option, so just letting you know you can use a paid option to use it freely abroad.

Withdrawing cash might be another trap. Even in Germany, you pay 5.4% fee for withdrawing cash from an ATM. This is one of the most expensive cards for cash withdrawals. I would simply advise - never use this card at an ATM. However, again, with the Travel+ paid option you get 5 free withdrawals per month.

Using the card abroad & the travel option

As mentioned earlier, the card charges a 1.5% currency conversion fee when paying in foreign currency. It also charges 5.4% for cash withdrawals - I'd never use such a card for travelling abroad, especially to the non-EUR countries. However, the paid optional Travel+ option changes the game completely. With this option you get 0% currency conversion fee, and 5 free ATM withdrawals per month for free worldwide. The travel option costs 7.99 EUR per month and includes travel insurance which protects you from accidents, baggage delays, and covers medical treatment abroad. The insurance is provided in partnership with Zurich Insurance Europe AG Deutschland and the package looks good, although pretty standard You get what you pay for.

A pro tip

Use travel option on demand - once enabled you pay for the entire month - don't forget to disable it when you don't need it.

My issue with this package is that it doesn't include car rental and liability insurances. It also doesn't have purchase protection insurance.

Flexible repayments

The card operates in two modes: Charge and Revolving. You can set one mode at the start and change it later. Beware revolving mode incurs interest since you're paying only a portion of the monthly bill. The interest rate set by Amazon Visa is very high and among the highest on the market at eff. 20.13% p.a.

Installment repayments

Some, but not all card transactions are eligible for Installment payments. I believe the criteria is that to be eligible your transaction needs to be more than 100 EUR. When the transaction is settled you'll see an option in the app to convert this debt into an installment payment. The bad part about this experience is that the app doesn't tell you what's the interest rate and the total amount to pay is going to be. It just warns you you'll lose all you amazon points as a result of converting that transaction into an installment payment. No, thanks!

You can select between 2,3 and 6 repayments (up to 7). Which is ok, but other banks offer longer terms for similar type of installment payments - just in case.

Withdrawing money from the card to a bank account

A very useful feature for some is that you can use the card as a source of a quick loan with no additional processes. You can just get money from your card to your reference account. It doesn't cost you anything - the money will be just transferred to you reference bank account and the debt will be sitting in the bill for the current month. You can repay your debt in multiple ways including setting it up as an installment repayment and pay for it across multiple months as if it was a standard loan.

Known Issues

Interestingly enough, when I looked at the feedback that people post online, I noticed people leave a lot of negative comments about this card. I did experience some of the issues described, but tbh, I don't think those issues as severe as they're portrayed by some people. The card worked pretty reliably for me. I had just one instance when it got declined at a shop, but passed through normally at the second attempt.

Another thing that people are complaining about is the annoying security measures. The app is a bit anxious and paranoid sometimes asking you to enter you biometrics as well as the one-time code for most of the sensitive transactions or just to lookup your card details. Hopefully Zinnia's team will take into account the usability concerns related to be too paranoid, so the UX can be better. I mean, if I'm in the app logged in with biometrics, why would you ask me for biometrics again to see the card details and then send me a code over SMS to enter.

Recently I've been experiencing issues with the app. For three days in a row I wasn't able to log in to the app which told me there's a technical issue they're working on. I personally don't think it's acceptable to have such a long downtime:

Amazon Visa app crashing

Amazon Visa app crashingOne more thing I experienced recently was related to Amazon. The app notified me there was a problem with crediting points and they are working on the resolution. I'm not sure what the problem was but indeed the Amazon account showed a problem as well. Luckily after clicking to renew the points info, everything showed up correctly and it matches the cashback that I earned on the card. Eventually everything is resolved:

A problem with bonus points on amazon.de

A problem with bonus points on amazon.de Bonus points appeared back in a couple of days

Bonus points appeared back in a couple of days Bonus points used to buy on amazon.de

Bonus points used to buy on amazon.deOverall, you can see there are issues every now and then. The Zinia team needs to do something to bring it to the level of a quality product.

Annoying security

When the card is added and used in the context of paying on amazon.de - the experience is just seamless. You pay in one click and don't have to enter any codes or confirmations for your credit card transactions. It's a different experience elsewhere - the security features of the app apparently haven't been thought through and sometimes the app is just paranoid about some unnecessary “extra security”. One simple example - to see the card details to enter them when paying online - you'd need to go through a cycle of logging into the app with 2 factor authentication, which involves fingerprint or face id recognition, and then you'd also need to enter an OTP coming as an sms. Another example would be paying online involving visa 3ds security - where again you'd need to lookup the confirmation Visa 3Ds code as well as an OTP sent to your phone number - like why would I need to verify with an SMS code if I provided biometrics - all just to lookup the card's details. Feels just like something is disconnected somewhere and sometimes it feels just too much.

Putting it all together

Despite numerous issues accessing the account via the app and the card being declined for no reason a couple of times here and there - it's still a pretty good product. The card would be a perfect addition to anyone's wallet, even if you're going to be using it only for amazon.de. It doesn't cost you anything to own one, even if you don't use it actively.

I like the flexibility of the travel option which can be enabled for the periods of traveling and disabled shortly after, instead of paying an annual fee for a credit card that includes insurance and travel perks at all times. That's a very rare model, but I find it very valid and useful.

This card definitely has its own take and flavor, and I'll continue using it for my Amazon purchases, and maybe who knows will try it out on the next trip with its travel option.

This card is very suitable as an everyday card - you can pay around with Google or Apple Pay. Using a physical card in stores or when buying your morning coffee - you receive 0.5% cashback which later can be used for ordering stuff from Amazon. It shines when used as a default payment on Amazon as you'd receive 1% back in this scenario. The only downside here would be cash withdrawals - just don't do them with this card without the Travel+ option enabled.

The card is fine for traveling too when the travel option is enabled. This will let you pay around without worrying about the currency conversion fees and you can withdraw cash with no fees too.

Tips:

- Use the card in charge mode only (full monthly repayments)

- Don't forget to enable Travel option when using the card in a non-EWR zone to avoid high fees

- Don't withdraw cash without Travel+ enabled

- Set the card as a default payment on amazon.de

Alternatives

Here are some other cards you'd want to consider, especially when traveling abroad. They are free, have 0% fee for currency conversion or cash withdrawals and in the list below C24 card also earns you cashback, although a smaller one! See more credit cards and filter to match your prefference using the Credit card comparison tool!

Barclays Visa

Hanseatic GenialCard

Dmitry Filippov

Fintech author at Supafinance.de